For this report, we are examining the Connecticut real estate market and we are focusing on three property types: single-family homes, condominiums, and multi-family homes.

The Connecticut housing market experienced trends consistent with other New England states in that sales decreased, and prices increased when compared to the first six months of 2023 which also saw sales declines from the previous year due to the adjusting market and rising mortgage rates and inflation.

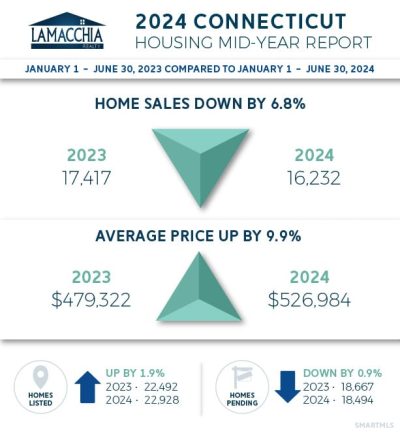

Number of Homes Sold Decreased by 6.8%

Home sales decreased in all three categories, down by 6.8% now at 16,232 total sales compared to the first half of 2023 which exhibited 17,417 sales.

- Single family sales decreased by 7.3%, condos are down by 5.5% and multis are down by 5.9%. It should be stated that last year’s declines were much higher so though sales were down for the first half of 2024, overall the market is improving.

- With a slight increase in listings (see Homes Listed section below), buyers have had a few more options this year, but not enough to surpass sales when compared to this time last year.

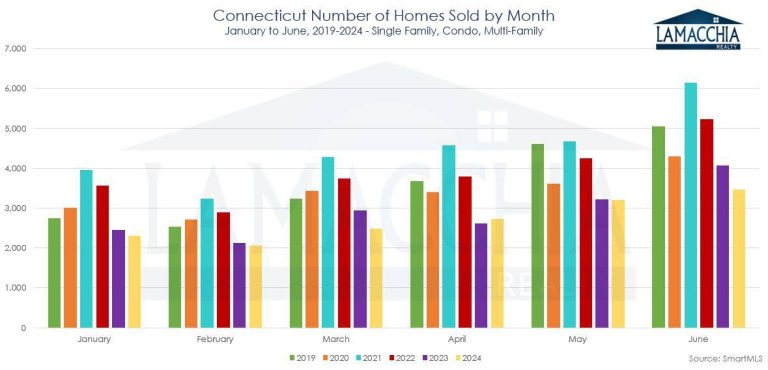

- The chart below depicts that 2023 was the beginning of the market adjustment with sales much lower than 2022, incapable of keeping pace with 2021 as the buyer pool diminished with previous buyers making purchases or deciding to keep renting. 2024, with the rising prices and mortgage rates in the 7% range, struggled to keep up with last year and fell short by 6.8%.

Prices Increase 9.9%

Average prices for homes climbed to $526,984 in the first half of 2024, a 9.9% increase from the first six months of 2023 at $479,322.

- Prices increased in all three categories: singles are up by 9.6%, condos are up by 9.8% and multis are up by 17.4%.

- Listings have slightly improved in volume so far this year by 1.9%, which contributes to the rise in inventory in CT. As of June 2024, inventory is finally reaching levels higher than last year (yellow line in the graph to the right) after starting the year with the lowest levels since 2017.

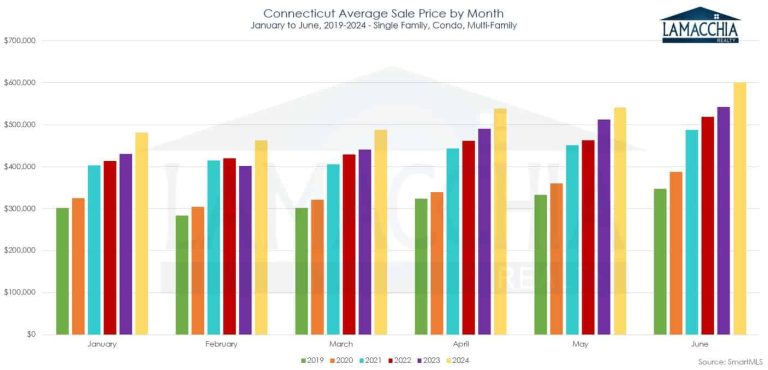

- Prices have been rising in Connecticut for years, but there was the Covid-era spike due to frenzied demand and since then a drop just hasn’t happened due to historically low inventory. Again, as mentioned earlier, the extremely tight Connecticut inventory will make it very unlikely that we will see a price drop.

- If rates are a strong deterrent for buyers looking for more affordable monthly payments, there are several alternative options such as mortgage buydowns or assumptions that are worth exploring.

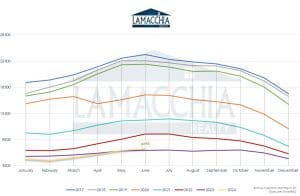

- The graph below shows how monthly prices over the past four years have steadily increased, with 2024 making wider strides than previous years.

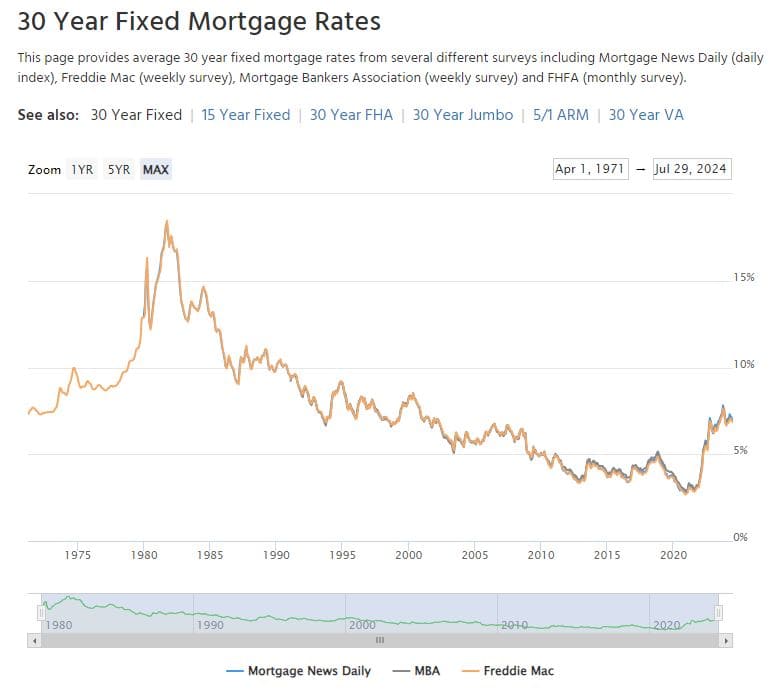

- Recent years of exceptionally low interest rates have led to inflated expectations. Today’s rates, falling within the 6%-7% range, are more aligned with historical norms. As time passes, these rates will feel increasingly familiar.

- Delaying a home purchase solely due to interest rates is often unwise. While refinancing could potentially yield savings if rates drop substantially, it’s important to remember that rising home values might counteract these benefits.

Homes Listed for Sale in CT

There were 22,928 homes listed for sale in the first half of 2024 compared to 22,492 last year, a slight increase of 1.9%.

- Many sellers are hesitating to put their homes on the market, therefore, the number of new listings is down year over year. Connecticut consistently has the lowest inventory of all New England states, and therefore the lowest chance of prices dropping.

- This time last year we published a report on how the number of new listings in the first half of 2023 was the lowest in recorded history, since 1995. You’ll see how in the chart below, the red line depicts 2023 as the lowest year, and this year is negligibly higher than that, but still significantly lower than any other year.

Pending Home Sales (contracts accepted)

The number of homes placed under contract declined slightly by 0.9% year over year with 18,494 pending sales over 18,667 last year this time.

- With only a slight increase in listings and inventory rising slowly, it is to be expected that pending sales are also slightly lower year over year. The market in Connecticut is especially tight given inventory levels. This, combined with existing stains on buyer affordability, will keep pending sales lower.

Predictions for the Rest of the Year

Connecticut’s housing market mirrors national trends with declining sales and rising prices which aligns with our earlier predictions. However, an exceptionally tight inventory sets the state apart.

Many sellers are reluctant to list due to lower interest rates available during the pandemic. With current rates around 7% and little prospect of significant change, sellers are primarily motivated by life events such as divorce, growing families, relocation, or downsizing. Despite this, inventory remains insufficient to meet demand, pushing prices upward.

Buyers face challenges with reduced affordability due to higher rates and prices. Staying informed about interest rate fluctuations and maintaining pre-approvals is crucial to be ready to strike if rates drop.

Homeownership offers benefits beyond renting, including property control, predictable costs, equity building, and potential tax advantages.

The current market favors sellers in the first half of the year, shifting towards buyers in the latter half. Listing now can maximize benefits, especially with competitive pricing. Delaying could mean missing out on the right property when it becomes time to buy.

National factors, including commission changes and the upcoming election, influence the market. Beginning in August, a new rule will require buyers to pay their own agent’s commission, while sellers will only cover the commission for their agent. This change could have negatively impacted veterans using VA loans, but a temporary adjustment has been made to protect their benefits. However, buyers will likely face increased costs as the agent’s fee can no longer be rolled into the mortgage. These new commission rules may impact buyer affordability, potentially slowing the market this winter. However, a more active market is anticipated for 2025.

Data provided by SmartMLS then compared to the prior year.