August Highlights

- Buyers, it is officially Fall which means the next 60 days will be the best

time to buy all year! Anthony explains why in this video here!

time to buy all year! Anthony explains why in this video here! - Mortgage rates stayed between 7% and right under 7.5% during the month of August. Given current economic conditions & performance, many experts do not believe rates will decline anytime soon. In fact, they could go up even more as the year comes to a close. Also, while not directly tied to mortgage rates, many believe the Federal Reserve will increase rates one more time in November.

- Serious buyers who are ready to purchase need to be prepared with updated preapprovals and informed of their mortgage options so they can successfully purchase a home this Fall!

- In New Hampshire, the number of homes sold is down when compared to the same time last year. Inventory levels are struggling to keep up with the significant buyer demand currently in the market. As such, active buyers are faced with fewer and fewer options to choose from. Also, given the natural seasonality of the Northeast market, inventory levels will only further tighten as market activity slows toward the end of 2023.

- Additionally, the number of homes listed is also down year over year. Many want-to-be sellers are hesitating to list their homes to avoid entering the market with current mortgage rates. Some sellers are hesitating to list because of the availability of homes on the market, and they are concerned that they won’t have anywhere to go next if they do decide to sell.

- There are some sellers who can no longer delay putting their home on the market due to changes in life circumstances such as divorce or a growing family. In this case, prepping your home correctly for a Fall sale will be crucial so you can attract the most buyers. The more demand you create for your home, the more negotiating power you have – especially if you are buying and selling at the same time.

- Average sales price is up in August when compared to the same time last year. Typically, a low supply, high demand situation would lead to a larger increase in prices. However, other economic factors such as inflation and increased mortgage rates are altering the scenario by keeping overall consumer affordability diminished which, in turn, will keep housing prices from soaring uncontrollably.

NEW HAMPSHIRE

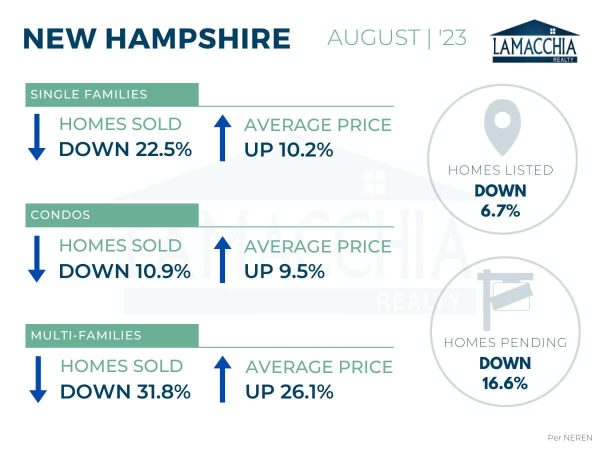

Home Sales Down, Average Prices Up

Home sales are down 20.4% year over year, with August 2023 at 1,773 compared to 2,228 last August. Sales are down across all categories.

- Single families: 1,671 (2022) | 1,295 (2023)

- Condominiums: 469 (2022) | 418 (2023)

- Multi-families: 88 (2022) | 60 (2023)

Average sales price increased by 9.9% when compared to last August, now at $544,508. Prices increased across all categories.

- Single families: $527,049 (2022) | $580,585 (2023)

- Condominiums: $393,648 (2022) | $430,978 (2023)

- Multi-families: $441,429 (2022) | $556,772 (2023)

Homes Listed For Sale:

The number of homes listed is down by 6.7% when compared to August 2022, as want-to-be sellers are concerned about jumping into the market.

- 2023: 2,075

- 2022: 2,223

- 2021: 2,644

Pending Home Sales:

The number of homes placed under contract is down by 16.6% when compared to August 2022.

- 2023: 1,916

- 2022: 2,296

- 2021: 2,596

Data provided by NEREN then compared to the prior year.