Amidst ceaseless mortgage rate hike and inflationary headlines, the mortgage industry is abuzz with talk of buydowns. Buydowns aren’t a new product, on the contrary they’ve been around for a long time, but they’re resurfacing now as a mechanism to combat the rising mortgage rates. There are two types of common temporary buydowns, a 2-1 buydown, and a 1-year buydown.

Watch the videos below to hear Anthony explain and give an example of how Buydowns work.

What is a TEMPORARY buydown?

A buydown allows a borrower to lower the effective mortgage rate upfront so the monthly mortgage payments are lower during the agreed upon term. Buydowns work with conventional loans, FHA, and VA loans only, not jumbo loans.

For example, on a $500,000 purchase price with 20% down ($100,000) the borrower must qualify for a 30-year fixed rate mortgage at current rate. In this instance, the monthly mortgage payment (principal and interest) would be $2,667.93.

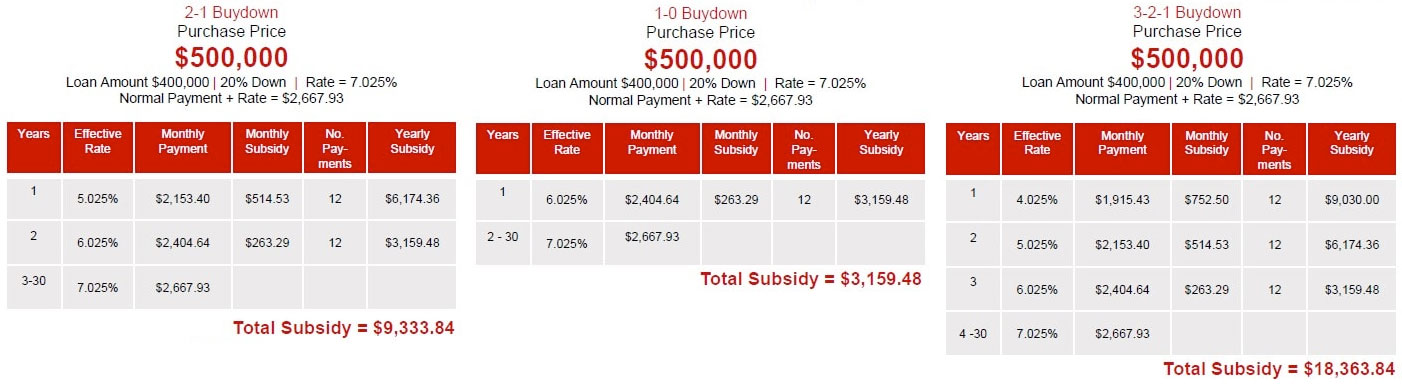

On a 2-1 buydown, in this example, $9,333.84 goes into an escrow account at closing. The lender ultimately takes dollars from the escrow account each month during the term of a buydown to cover the difference between the lower payments and what is due. The buyer is then able to pay as if they had a rate that is 2% lower for the first year and 1% lower for the second year, hence the name ‘2-1 buydown.’ The benefit of this escrow account is that the money belongs to the borrower. If rates decrease enough that it makes sense for the borrower to refinance, that money isn’t lost, the money is credited back to the borrower. Year one, with the 7.025% rate lowered by 2% to 5.025%, the borrower pays $514.53 less every month and year two, they pay $263.29 less than they would with the rate going up 1% to 6.025%. Year three the money in the escrow account has been used towards all eligible payments and the payment goes back up to what it was locked into at closing. The monthly payments rise to what they would have been at the start without a buydown at $2,667.93 and they stay at that level for the remaining life of the mortgage, years 3-30. See example.

A 1-0 buydown is also the same idea only it only lasts 1 year, the payment goes down as if the rate was 1% less and costs less to the seller. See example above.

In a 3-2-1 buydown the same rules apply but it goes three years and in year 1 the rate goes down 3%, year 2 the rate goes down 2%, and year 3 the rate goes down 1%. It lasts longer but also costs more to the seller.

What’s in it for the buyers?

The buyer qualifies for the current rate but benefits from a lower monthly payment during the agreed upon term of the buydown. This works for some borrowers who anticipate an income increase during the term of the buydown so that when the buydown ends, they’ll be back up to the full payment with more funds to cover the costs. A borrower may also anticipate mortgage rates to drop within the next couple of years, allowing them the option to refinance to a lower rate before the end of their buydown term. In this case, the buyer would refinance to a lower rate and the remainder of the money from escrow would be applied to the payoff of the original loan.

The caveat is that the buyer and their lender need to have this worked out to the penny before even making the offer as it needs to be included in that as well as the P&S exactly. If these numbers for the seller concession request are off at all in the offer or the P&S, there will be a hold up at closing and put the sale in jeopardy. For a 3-2-1 buydown the seller needs to concede 3.8% of the purchase price, for a 2-1 buydown the concession is 2.3%, and for a 1 buydown the seller concedes 1.6%.

The buyer may request additional closing costs be credited in addition to the buydown, but can not exceed allowable maximum seller concession credit for the loan. The closing credit maximums depend on the type of the loan, but they range from 2% to as much as 6%.

- VA– 4% (can cover Funding Fee)

- FHA– 6% (can cover Upfront MIP)

- USDA– 6% (can cover Guarantee Fee)

- Fannie/Freddie: For Primary Residence:

- >90% 3%

- 75-90% 6% LTV

- 75% or less 9%

- All investment properties 2%

Why would a seller concede money towards a buyer’s buydown?

Why would a seller give up this money at closing? There are a few potential reasons, the first being that the home just isn’t selling, and they want to attract a buyer without lowering their price. The seller then offers $9,333.84 at closing (see total subsidy in buydown chart) and sells for $500,000 instead of adjusting the price to $490,000. Buyers are willing to pay that premium for an easier time making mortgage payments during the buydown and sellers are able to net their desired sale price and get the deal done.

As well, sellers can even use their willingness to work with a buydown in their listing to attract more buyers. Just by putting “Seller would consider a 2-1 buydown concession” in their listing blurb, more agents and buyers could be attracted to make an offer.

This type of buydown is temporary, compared to traditional buydowns where a borrower pays a one-time fee at closing to lower the interest rate for the loan term, which could be 30 years. The traditional rate buydown works differently in this case as that money paid will be lost if the borrower ever refinances during the loan term. The upfront cost is typically much higher as well as it is to apply to the life of the loan instead of the first few years.

As always, mortgage products and programs like these are uniquely beneficial to borrowers depending on many factors. To learn more and determine if this makes sense for you as a buyer or to offer as a seller, contact your expert Realtor today.

What is a TRADITIONAL buydown?

Traditional Permanent mortgage rate buydowns are a financial tool that allows homebuyers to permanently pay a lower interest rate on their mortgage. This can be a useful option for buyers who expect their income to increase in the future or who are stretched to their budget limits at the current interest rate or who just want a lower monthly payment.

For example, consider a homebuyer named Jane who is looking to purchase a home for $300,000 with a 30-year fixed-rate mortgage at an interest rate of 7.4%. Jane’s monthly mortgage payments would be around $1,662 at 20% down, which is at the upper limits of her budget.

Jane has good credit and a steady job, but she expects her income to increase significantly in the next few years. She is considering a permanent mortgage rate buydown to lower her monthly payments in the short term, while still being able to afford the home of her dreams.

With a permanent mortgage rate buydown, Jane pays a fee upfront to permanently lower her interest rate to 6.5%. This reduces her monthly mortgage payments to around $1,517 making it more affordable for her to purchase the home.

One advantage of a permanent mortgage rate buydown is that it can protect against future interest rate increases. If interest rates rise after Jane has locked in a lower rate through a buydown, she will still be paying the lower rate for the duration of the loan.

However, it’s important to consider the potential downsides of a permanent mortgage rate buydown as well. One disadvantage is that they can be expensive. The fees associated with a buydown can add up, especially for a permanent buydown.

In Jane’s case, the fee for the permanent buydown is $6,700. It’s important to do the math and compare the costs and benefits of a buydown to other options, such as a higher down payment or a longer loan term, to ensure you’re making the best decision for your financial situation.

In conclusion, permanent mortgage rate buydowns can be a useful tool for homebuyers like Jane looking to lower their monthly mortgage payments or protect against future interest rate increases. However, it’s important to carefully consider the costs and benefits before deciding if a buydown is the right choice for you.

…

Lamacchia Realty, Inc. is not a licensed mortgage broker or lender. The information on this website is for illustrative and educational purposes only and is not intended as an offer or solicitation for any mortgage product or any financial instrument. Consult with a licensed mortgage broker or lender for specific loan products and for more information about underwriting guidelines, interest rates, borrower qualifications and other requirements you may need to meet to qualify for a mortgage loan or a loan assumption.