As stated last month in Anthony’s Predictions for 2025, “2024 will go down in history as the bottom of this down cycle.” Though we did see year over year increases in all categories, they were nominal where we prefer to see larger numbers.

In 2024, the South Florida single-family housing market saw rising prices despite rising inventory, and sales declined slightly. Rising insurance premiums added to the cost of homeownership, potentially affecting affordability. Despite challenges, the market showed resilience with strong price growth and stable demand. Despite rising costs, homeownership continued to be appealing due to fixed payments, equity growth, and potential tax benefits, highlighting its long-term value over renting.

South Florida’s condo market faced challenges due to rising insurance costs and climate concerns, especially in flood-prone areas. Insurance premiums surged because of the state’s vulnerability to hurricanes and flooding, which raised overall ownership costs and led to higher maintenance fees. Additionally, climate change, including rising sea levels and more frequent storms, made coastal properties less attractive to some buyers. However, the condo market remained resilient in popular areas with updated infrastructure or less risk, with continued demand in regions like Brickell and Downtown Miami.

This report breaks down sales, average prices, the number of active listings, and how many listings went under contract for 2024 compared to 2023 and discusses what is predicted to unfold in 2024.

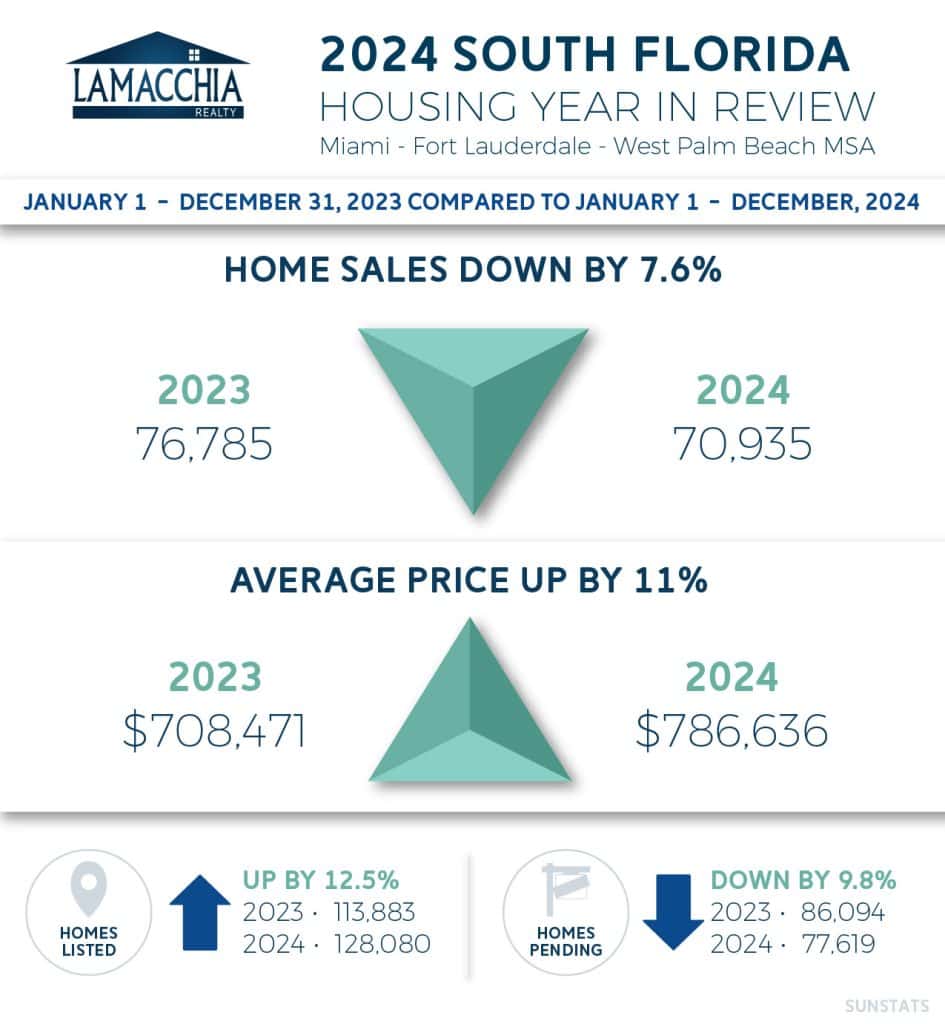

South Florida Sales Decline by 7.6%

Sales in South Florida decreased for both single family as well as condo/townhomes in 2024 when compared to 2023. Single families experienced just a slight decrease while condo/townhomes saw a more significant drop.

Sales were down in both categories:

- Single family sales down by 1.4%: 36,235 in 2024 from 36,749 in 2023

- Condo/townhome sales down by 13.3%: 34,700 in 2024 from 40,039 in 2023

Below is a graph that illustrates home sales per year since 2008 with single families in blue and condos/townhomes in green. After the pandemic, home sales for both categories skyrocketed and then have been declining since 2021. 2024 experienced nominal drops since 2023 indicating that the market may start to level out or adjust back to pre-pandemic levels going forward.

Monthly sales altogether fought to keep up year over year from 2023 and were down ten out of the twelve months in 2024. Some months were neck-in-neck but overall couldn’t outpace last year.

All three counties exhibited declines in sales indicating that the market as a whole was going through similar challenges, not just a single geographic area. The cost of ownership along with climate concerns contributed to the decline. However, the sharp increase in sales in 2021 and 2022 had a lot to do with people working from home which isn’t as prevalent anymore with people back in the office. The declines we have seen in the past few years are an indication of a market trying to reach equilibrium.

South Florida Average Prices Increase by 11%

Prices overall in 2024 increased over 2023 by $78,165 with 2024 at $786,636 compared to $708,471 in 2023. In 2024, several factors contributed to the rise in average home sales prices in South Florida: low inventory, strong demand (especially for single-family homes and luxury properties), rising construction costs, and economic conditions like inflation. The luxury market saw significant growth, driven by high-net-worth individuals, while continued demand from out-of-state buyers added further upward pressure. Additionally, higher insurance costs and the prospect of future lower mortgage rates also played roles in driving prices higher.

Prices increased in both categories:

- Single family prices increased by 11.1%: $1,025,676 in 2024 from $923,060 in 2023

- Condo/townhome prices increased by 5%: $537,206 in 2024 from $511,718 in 2023

The bar chart below highlights that 2024 recorded the highest average home prices since 2008 for both categories—and indeed, the highest on record. Single family prices have inflated due to demand and have been influenced by luxury sales prices. Condo prices, though still higher than last year, aren’t rising nearly as fast as single families due to challenges within that market with rising costs associated with condo living and regulations in place due to the Surfside Collapse.

Monthly prices overall in 2024 consistently exceeded those of 2023. The growth since COVID is evident when comparing the 2020 green line to the 2024 purple line, highlighting the substantial price increases over time.

Average prices increased across all South Florida counties in 2024. South Florida, despite a drop in sales has seen a steady rise in home value over the years due to demand and higher priced sales propping up average prices.

2024 Listings Rise for the First Time in Two Years

After two years of sharp declines in home listings, including 2023’s record low since 1994, 2024 saw a 12.5% increase in new listings with both categories combined. Many sellers, hesitant to part with their pandemic-era mortgage rates, had kept inventory low, resulting in limited options for buyers. However, as conditions shifted with regulations, insurance and going back into the office, many sellers decided it was time to make a move, causing a significant increase in listings, especially condos.

Pending Sales Decreased by 9.8%

2024 exhibited a decline in pending sales, consistent with the past three years. Pending sales are at a level not seen since 2009. Tight single-family inventory, and regulations making a condo/townhome purchase more costly than ever before have hindered pending sales over the past couple of years.

South Florida Housing Inventory is on the Rise

Inventory in South Florida has risen up nearly 2019 levels. The sharp decline in inventory from 2020 to the end of 2022 was a result of the frenzied post pandemic market where everyone thought that working from anywhere was going to be the new paradigm going forward. Combined with people going back to the office, climate making insurance premiums rise, and with more strict condo regulations, pending sales are declining leaving more inventory available on the market. Usually this indicates that prices may level out or at least not rise at the pace we’ve been seeing, so hopefully 2025 brings around some affordability relief.

Will the 2025 Real Estate Market Improve?

In 2025, the South Florida real estate market is expected to see moderate growth in the single-family home segment, with prices projected to increase but perhaps not at the pace we’ve seen over the past four years. The market will stabilize, with more sales and improved inventory if mortgage rates stabilize or decline. However, the condo market faces challenges due to rising costs and new safety regulations, leading to potential price declines. Despite these difficulties in the condo market, overall, the South Florida real estate market is expected to remain resilient, supported by strong demand and economic factors.

Active buyers will need to stay proactive and be ready to make quick decisions when they find a property that fits their needs. However, affordability issues are expected to continue due to the state’s historically high property values and high cost of living. The rental market is also likely to stay expensive, as demand for rental properties exceeds supply, offering little relief for renters. For sellers, the market is predicted to remain strong but more balanced, with realistic pricing necessary to draw in buyers in a less competitive environment.

Despite difficulties in the condo market, overall, the South Florida real estate market is expected to remain resilient, supported by strong demand and economic factors. As Anthony stated in his 2025 Predictions, “I believe 2025 will mark the beginning of this recovery, with 2026 poised to be a historic year for the industry as sales normalize.”